Using your super to invest in property is one of the ways to increase your wealth. Superannuation Law allows you to borrow to purchase property using a Self Managed Superannuation Fund (SMSF) structure established for this purpose as long as certain conditions are met.

In addition existing laws enable you to borrow and invest directly in any kind of property, including residential and commercial, allowing investors to use property as super wealth building and income generating tool.

How it works

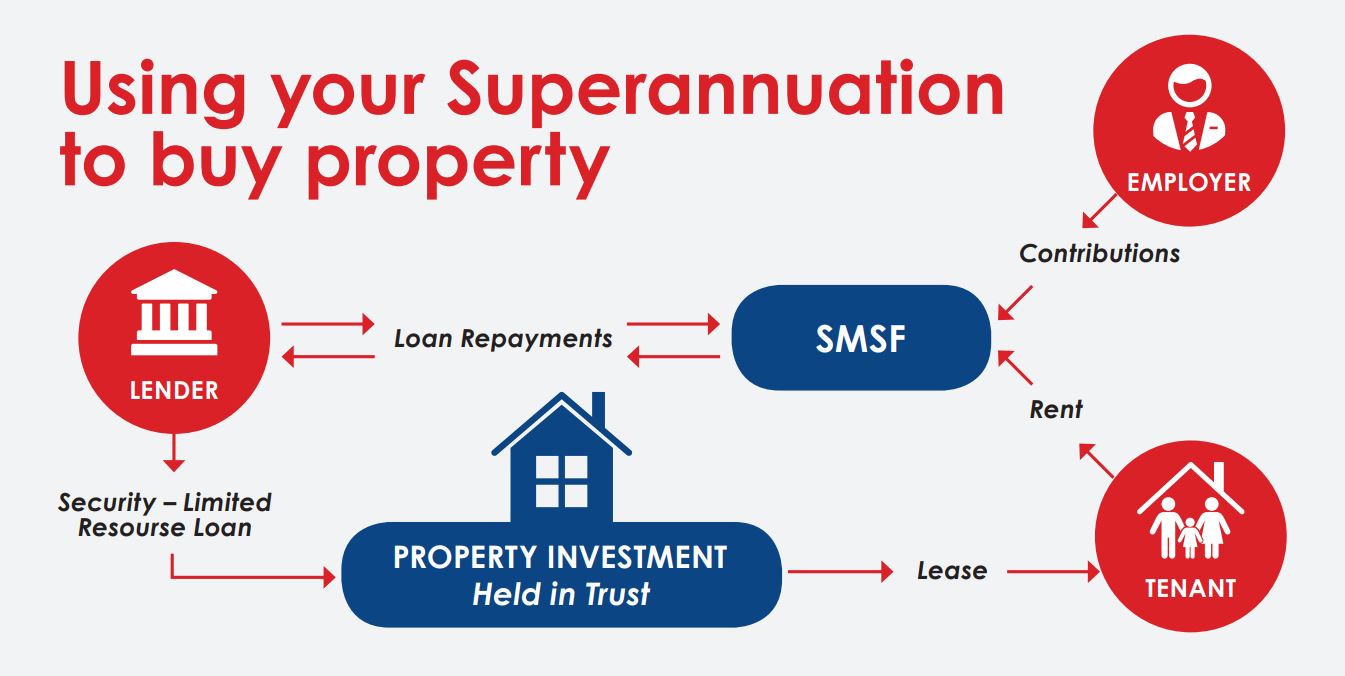

You want to invest in the property market using your superannuation [held in an SMSF] but cannot fund the full purchase price. The SMSF does however have enough to fund between 30% and 40% of the purchase price plus the other acquisition costs (range depends on type of property and lender requirements). The SMSF can purchase the property by borrowing the remaining funds to purchase the property. The property will be used as security for the borrowing under what is termed a ‘limited recourse loan’. In the event of default the lender only has recourse to the property and cannot claim any other SMSF assets. The property is held in trust for the SMSF which is entitled to its income. Your SMSF makes the loan repayments, paying off the loan over the agreed period. After the loan is repaid, the legal ownership of the property can be transferred to the SMSF.

What are the benefits?

There are distinct benefits associated with using your SMSF to buy an investment property. These include:

- Rental Income from property can be used to help repay the loan.

- Employer superannuation contributions can be used to help repay the loan.

- Members of SMSF can gain access to significant tax efficiencies, only available in the superannuation environment; including

- No capital gains tax once member(s) retire *

- Loan repayments can effectively become tax deductible (provided members salary sacrifice)

- Negative gearing benefits inside SMSF environment.

- Income after expenses and any capital gains on the disposal of property is taxed at a maximum rate of 15%, compared with rates of up to 47% that a regular investor would be paying.

- Assets held in a SMSF, will under normal circumstances, be protected against general debt recovery and bankruptcy proceedings.

- SMSF assets are secure as the lender does not have recourse to your SMSF assets in the event of default.

- Buying property may be an excellent way to reduce volatility and overall risk on your investment portfolio

Some things to consider

- Professional advice should be sought. A legal or accounting professional should discuss and establish the structure

- The investment in the property must be in line with the SMSF investment strategy.

- Any loan arrangements may be subject to the provision of personal guarantees, which may expose individual guarantors to potential liability.

Superannuation law is complex and as such, careful management and sound advice are of paramount importance. Investors should obtain legal and accounting advice when considering investing in property using their super or SMSF to fund the property purchase.

At Hailston + Co, we can show you how to realise these benefits and how you can control possible disadvantages. We have a service solution that provides exactly that, creating peace of mind for you now and in the future.

When to consider an SMSF loan

- You are wanting to purchase a property as an investment but you have:

- Lack of equity outside Super; and or

- Lack of servicing capacity outside Super

- Taxation benefits:

- Voluntary contributions

- CGT considerations

- You hold property outside the superannuation environment that is subject to land tax:

- * *SMSF’s have separate land tax thresholds in NSW

- You have a long term investment time frame

-

Don’t have a SMSF?

That’s OK. We can help you establish a fund to purchase your property. We can explain to you:

- The potential benefits and rules

- How much you need to have in super to be eligible?

- Is the property investment a good idea and is it appropriate for you?

- How to set up and structure the right type of SMSF.